ETH Price Prediction: Bullish Outlook as Technicals and Fundamentals Align

#ETH

- Technical Breakout: ETH price sustains above key moving averages with improving momentum indicators

- Institutional Adoption: $5B+ ETF inflows and major corporate purchases demonstrate growing mainstream acceptance

- Regulatory Clarity: Favorable policy developments remove uncertainty and encourage investment

ETH Price Prediction

Ethereum Technical Analysis: Bullish Momentum Building

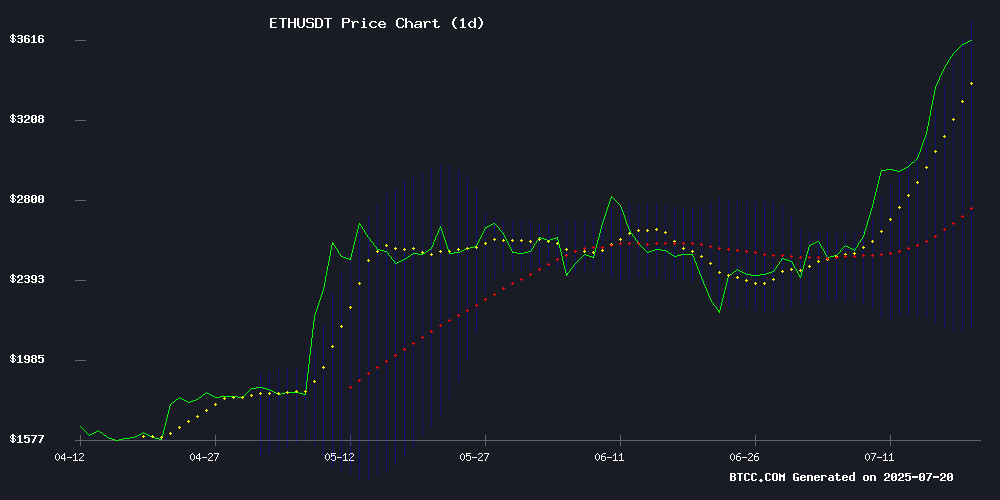

ETH is currently trading at $3,706.60, significantly above its 20-day moving average of $2,937.89, indicating strong bullish momentum. The MACD histogram shows improving momentum despite remaining in negative territory (-154.86), while price sits NEAR the upper Bollinger Band ($3,743.06), suggesting potential overbought conditions in the short term.

"The technical setup shows ETH is entering a strong bullish phase," said BTCC analyst William. "The break above the key $3,700 level combined with positive MACD convergence suggests this rally may have further room to run."

Regulatory Tailwinds Fuel Ethereum's Rally

Ethereum's 3.5% surge to $3,700 comes amid growing institutional interest, with ETFs surpassing $5B in inflows and SharpLink's $73M ETH purchase. "The combination of regulatory clarity and ETF momentum is creating perfect conditions for ETH," noted William. "These fundamental developments validate the technical breakout."

Factors Influencing ETH's Price

Ethereum Surges 3.5% to Break Above $3,700 Amid Regulatory Clarity and ETF Momentum

Ethereum rallied 3.48% in 24 hours, breaching the $3,500 resistance level as regulatory developments and institutional demand fueled inflows. The GENIUS Act's passage solidifies Ethereum's role as the leading platform for stablecoin issuance, with over $80 billion of Tether circulating on its network.

BlackRock's updated Ethereum ETF proposal, now including staking integration, has accelerated institutional interest. U.S.-listed Ethereum ETFs saw a 40% monthly increase in assets under management, reaching $14.87 billion.

Technically, Ethereum's breakout above $3,500 confirms bullish momentum, though overbought signals suggest potential near-term consolidation. The RSI-7 sits at an extreme 94.9, while the MACD histogram reflects strong but potentially exhausted buying pressure.

Ethereum ETFs Surpass $5 Billion in Net Inflows as Investor Appetite Grows

US spot Ethereum ETFs have crossed the $5 billion net inflow threshold for the first time since their approval a year ago. BlackRock's iShares Ethereum Trust (ETHA) led the charge, accounting for $675 million of last week's $908 million inflows. The remaining $233 million was distributed among other issuers.

The recent surge marks a dramatic turnaround from earlier struggles. Initial outflows, particularly from Grayscale's trust, had plagued the products for months. Now, with $181 million daily inflows last week—far exceeding the $23 million average since launch—the tide has clearly shifted.

Total net inflows now stand at $5.6 billion, with assets under management exceeding $14 billion when including price appreciation and converted Grayscale funds. This resurgence suggests growing institutional confidence in Ethereum's long-term value proposition.

SharpLink Expands ETH Holdings with $73M Purchase, Stock Surges 10%

SharpLink Gaming (NASDAQ: SBET) saw its shares climb 10.3% to $23.88 following its latest acquisition of $73 million worth of Ethereum. The purchase, executed via Coinbase Prime, adds 24,371 ETH to the company's rapidly growing crypto treasury. This marks the third major ETH buy in four days, bringing SharpLink's total accumulation to 62,232 ETH—valued at approximately $186.4 million.

The company has emerged as one of the most aggressive corporate buyers of Ethereum, amassing roughly 294,000 ETH since late May. Nearly a quarter of these holdings (74,464 ETH) are currently staked, reflecting a long-term commitment to the asset. The strategic pivot follows a $425 million private placement led by Ethereum co-founder Joseph Lubin, now SharpLink's chairman.

Ether prices briefly topped $3,000 before settling at $2,972, down 2.38% on the day. Transactions originated from a Coinbase Prime hot wallet showing active movement of ETH and other tokens including Shiba Inu and Uniswap.

Is ETH a good investment?

Based on current technical and fundamental factors, ETH presents a compelling investment opportunity:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +26.2% premium | Strong bullish trend |

| MACD | Converging | Momentum building |

| Bollinger Bands | Upper band test | Potential short-term consolidation |

| ETF Inflows | $5B+ | Sustained institutional demand |

"ETH checks all the boxes for a high-conviction crypto investment," said William. "While short-term pullbacks are possible, the structural bull case remains intact."

The alignment of technical breakout patterns with strong fundamental catalysts makes ETH an attractive investment with clear upside potential.